For detailed information and questions, please don’t hesitate to reach out to your Allen Insurance and Financial benefits team. 2020 Checklist (PDF)

For detailed information and questions, please don’t hesitate to reach out to your Allen Insurance and Financial benefits team. 2020 Checklist (PDF)

Maine’s three providers of individual health insurance on the Affordable Care Act marketplace have revised their rate requests for 2020, significantly lowering their projected rates.

This is good news for anyone who plans to enroll or to renew their coverage in health insurance via the Affordable Care Act for 2020.

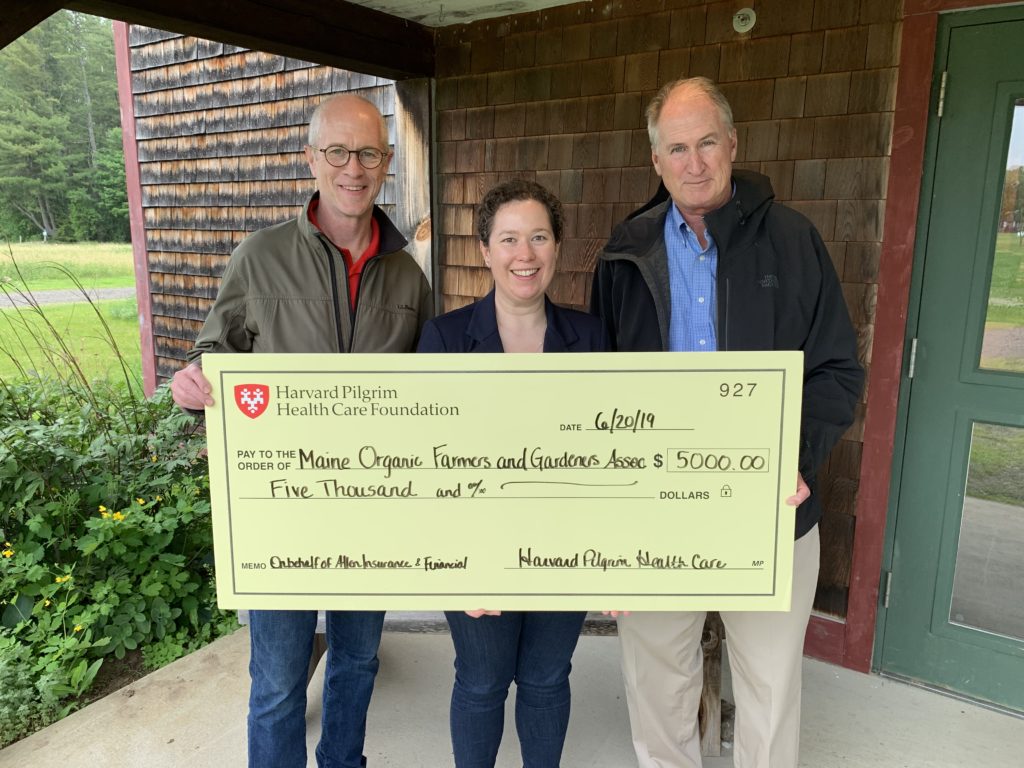

The Maine Organic Farmers and Gardeners Association (MOFGA) recently received a $5,000 grant from Harvard Pilgrim Health Care Foundation and Allen Insurance and Financial to increase access to and affordability of healthy, nutritious food for low income families. MOGFA has a longstanding commitment to help all Maine people acquire local, organic foods regardless of geography or income. Pictured in the photo, left to right, are: Bill Whitmore, Maine Market Vice President, Harvard Pilgrim Health Care; Sarah Alexander, Executive Director, Maine Organic Farmers and Gardeners Association; and Dan Wyman, JD, Insured Benefits Manager, Allen Insurance and Financial.

There are some new rules in Maine around Workers Compensation Insurance and Independent Contractors. The Maine Workers Compensation Board has issued a newsletter with some important information.

Independent contractors are workers who perform services for remuneration under a verbal or written contract, but who are not under the essential control or superintendence of another person, both under the person’s contract of service and in fact. The worker must also meet specific criteria.

In order for a person to be an independent contractor they must meet the test in §102(13-A) of the Workers’ Compensation Act. An independent contractor is not required to have workers’ compensation insurance; however an independent contractor is required to have workers’ compensation insurance for any employees hired by the independent contractor.

Newsletter from Maine Workers Compensation Board – June 2019

Many employers offer high deductible health plans (HDHPs) to control premium costs and pair this coverage with HSAs to help employees with their health care expenses. Due to an HSA’s potential tax savings, federal tax law includes strict rules for HSA contributions. Click here for a Compliance Overview summarizes the contribution rules for HSAs. (PDF, new window)

Whenever you own and operate a motor vehicle, regardless if it is for recreation or normal transportation, it is critical to follow all of Maine’s legal requirements, both for insurance coverage and for who rides (and operates) the vehicle.

With regards to ATVs, there are unique requirements specific to Maine, so if you’ve moved from out of state, or if you recently purchased such a vehicle, it is necessary to stay up to date on the latest regulations.

In Maine, no person under the age of 10 may operate an ATV. Anyone younger than 16 must first successfully complete a training course approved by the state. They must also be accompanied by an adult.

Anyone under the age of 16 is not allowed to cross any public way outside of the purpose of crossing as directly as possible while ensuring it does not interfere with traffic approaching from either direction.

It is important to have ATV insurance coverage. With potential roll overs, damaged fenders or vehicles submerged in water during operation, you do not want to be forced to pay for costly repairs on your own. ATV insurance may also cover theft, whether on your property or if you are towing it to a recreational location.

Just like with your automobile, you need to have an active registration on any ATV you own and operate.

Some costs to consider include:

• Resident registration is $33 annually

• Nonresident registration is $68

• Nonresidents may apply for a 7-day $53 ATV registration

There is also a free ATV weekend currently scheduled for Aug. 16-18, 2019.

To make sure you and your vehicle are properly protected, make sure to contact Allen Insurance and Financial for insurance quotes on your ATV.

Like a car, you must register your snowmobile if you own it in Maine. When it comes to insurance, however, the law is much more flexible. In fact, there are no real Maine snowmobile insurance requirements or licensing requirements – only laws determining who can ride, as well as how and where they can ride.

That does not mean you should be without insurance coverage, though. Snowmobiles are not only fun and practical, but they can also be dangerous. Having the right insurance can protect you against major losses and financially devastating liability.

Third-Party Snowmobile Insurance Requirements

Even though the state does not require snowmobile insurance, you may still be required to purchase coverage from a third party.

For example, if you financed the purchase of your snowmobile, your lender will probably want you to purchase insurance that protects your sled against physical damages until your note is paid in full. If you store your snowmobile somewhere other than your home, the property manager may also require proof of coverage.

Types of Snowmobile Coverage

Snowmobile insurance is usually no more than a few hundred dollars per year, but it can save you tens of thousands of dollars in injury, property, and liability damages. Even the safest of drivers can fall through ice on their sled or run into a fence in poor visibility.

Depending on the terms of your coverage, your policy may protect you against a wide range of snowmobile-related claims, including:

• Collision damages

• Non-collision damages, such as fire or theft

• Injury to you and your passengers

• Victim medical expenses

• Property damage liability

• Legal fees if you are sued

• Judgments and settlements if you lose your defense

At Allen Insurance and Financial, we can help you assess your risks and examine various options to minimize your exposure to loss. For more information or to request your snowmobile insurance quote, contact our office today.

Health insurance is a valuable benefit offered by businesses to their employees. You’re glad it’s there, but let’s be realistic – when it comes to the paperwork involved, we know many people would rather be doing something else. Here are some best practices to streamline your business’s health insurance enrollment.

1. Plan ahead by creating a realistic schedule for open enrollment by beginning with the end in mind.

Ideally, your open enrollment period should end no later than 30 days prior to the end of your plan year or renewal date. This kind of timely action builds in a buffer for delay or error in the process.

Once you determine the ending date of open enrollment, back up from there to schedule open enrollment meetings, print forms or materials, distribute or mail open enrollment packets, etc. We’re here to help.

2. Collect all required information for each plan participant (employee or dependent).

This may include:

3. Double-check all data. Accurate completion of all fields on any enrollment or waiver forms now saves time, delay and aggravation later. Insurance companies can use only the information they are given.

4. Educate employees about the guidelines of spending accounts associated with their health coverage. For example, FSAs are “use it or lose it” accounts, where contributions made to an FSA during a calendar year can be used only for eligible expenses incurred during the same year – unless your plan provides for either a grace period or a carryover.

And – if your employees have flex debit cards, remind them to save all receipts for purchases made with the card as well as the cards themselves, even if the allocated FSA total amount has already been used.

Additionally, discussing these items with your agent can help with the decision-making process: Your budget for health insurance and contribution strategy (for the business and for the individual employee) and the health insurance networks the insured employees use or prefer to use.

The very first thing you need to know about flood insurance is that it is not included in a standard homeowners insurance policy.

Sometimes a property is in a flood zone and a lender requires flood insurance. Perhaps the flood maps in your area have changed and your property (or part of it) has been mapped into a flood zone. We can help with flood insurance as well as share some resources to help answer questions about the new map.

But also consider that for the purposes of insurance, flood losses include those resulting from water overflowing rivers or streams, heavy or prolonged rain, storm surge, snow melt, blocked storm drainage systems, broken dams or levees or other similar causes.

Flood insurance is complicated. It’s expensive only sometimes. Each case is as unique as the property to be covered, which is why it’s best to talk with your insurance agent. National Flood Insurance Program insurance can be purchased only with the help of an appointed insurance agent. We can help.

We can run a flood zone determination and a flood insurance quote. There is no charge for this. Even if your property isn’t on the coast, or a lake or a pond, it’s worth your time.