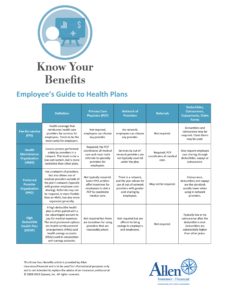

Benefit plans are sometimes confusing and employees might be struggling to understand what is offered to them. The Allen Insurance benefits division has shared this handy chart with definitions and explanations with our clients. Click for a PDF.

Insurance Question and Answer Speed Round

By Cale Pickford

Originally submitted to Maine Realtor Magazine | Summer 2021

Independent insurance agents tend to field questions that follow a familiar pattern. Just as real estate agents with a few years experience under their belt can probably anticipate and questions from buyers and sellers before they are even asked, so it is with insurance. As sales and service professionals, we welcome our client’s questions as they show that the client is engaged and working through the details of selling or buying a home.

We are advisors and our ability to carefully listen and respond is the value of our service, especially when considered against the back-drop of the click-bait, lead-capture mine field that is the modern search engine. (Have you ever clicked to see what mortgage rate you’re eligible for?)

Here are a few excellent questions that independent insurance agents frequently hear.

How do I insure property in self-storage units?

People accumulate an extraordinary amount of property after they have lived in the same home for an extended period of time. Children move out of the nest and leave behind all manner of treasures, things too precious to allow their parents to give or throw away but not quite important enough to bring along as they begin their own personal quest to accumulate way more than they will ever need. On the other side, prized possessions of late parents and relatives also tend to trickle down to the next generation. It seems people cannot quite bring themselves to throw away that moth-eaten mink stole or home videos that should be converted to digital copies, someday. In response to this mountain of loved but unneeded property are acres and acres of self-storage facilities and pods. In some cases, homeowners’ insurance policies will provide world-wide coverage for personal property, including those items held in storage units, but with a limit of 10% of the total amount of coverage on the policy. With some carriers, you need to modify the existing homeowners policy to include property held in storage facilities with a specific limit of coverage. As with most personal property coverage, there are caps for certain high value categories of possessions, such as jewelry, watches, furs and firearms. If someone is between homes. having sold their home and figuring out what is next, they should look to the storage facility or specialized insurers who specifically provide insurance for this category of property. Bottom line: Ask your agent, as each insurer treats this category of property a little differently and never make the assumption that it is insured automatically.

Does my homeowners policy cover outbuildings (garage/sauna/yoga studio/shed) on my property? Almost all homeowners policies automatically provide a certain level of coverage for “other structures.” The coverage, generally set at 10% of the dwelling value, insures structures and things that are not attached to your house. Some examples of property that would be repaired or replaced if damaged by a covered peril are garages, guest houses, patios, dining areas, mailboxes and walkways. Limitations and exclusions to this automatic coverage do apply. For example, piers and wharves are covered but most insurers exclude marine-related loss such as wave action and the lifting and crushing of ice. Also, if a detached structure is tenant-occupied or used to conduct business, the policy will need to be modified to make sure the homeowner is properly insured. If the built-in coverage is not enough, you may have the option to increase the other structures limits. Also, if there is a lot of value in these detached structures, it is wise to have a discussion with your insurance agent to see if guaranteed replacement cost coverage applies, as this coverage mandates that the insurer replace or repair the damaged structure even if the cost to rebuild exceeds the limit of coverage. Depending on the insurer, pools can either be covered under the dwelling or other structures coverage. Above-ground pools are usually considered personal property.

Does bundling insurance really save money?

The quick answer is yes. Insurers hire legions of actuaries to keep a very close eye on the characteristics of the most profitable accounts. The goal is to avoid or charge more for accounts that are predicted to lose money, and be more aggressive with pricing on the accounts where a profit is expected. One of the principles of insurance is spread of risk: Insurers know that if they insure both a home and vehicles they’re more likely to turn a profit than if they insured just one aspect of their client’s life. The insurers also know that accounts with multiple policies have better retention, which is driven by savings, familiarity of doing business, and convenience (or hassle to switch everything!). From the client’s coverage perspective, bundling insurance can also create a more efficient solution, with the potential to close gaps in coverage and eliminate redundancies.

What about deductibles?

With most insurers, the deductible can have a significant impact on both home and auto insurance premiums. Whether you are shopping for insurance or reviewing your current policies it is a great idea to price deductibles within a range so you can make a cost benefit decision with actual numbers. Often insurers who specialize in covering high value homes will greatly incentivize high deductibles, with some offering deductibles as high as $100,000. For insurers focused on more typical homes, deductibles ranging from $500 to $2,500 are most common. Another benefit of higher deductibles is that they impose some discipline on filing claims. Claims history is a very important part of insurance underwriting and even very small homeowners claims can have a significant impact on insurance eligibility and pricing. If you have a $1,000 deductible and an $1,800 loss it might be wise to self-insure (pay out of pocket) the cost of the repair rather than file the claim and risk your loss-free status. Furthermore, there’s always a chance that a more significant loss would occur in the near future, and having two claims in a short time span can have a major impact on access to insurance.

Flood Insurance: What’s new?

Flood insurance is always top of mind in a state like Maine with vast numbers of fresh and salt water adjacent real estate. York and Cumberland counties still have yet to adopt the new FEMA flood maps so be sure to be looking at both the current and future maps in these counties so your client can be proactive in mitigating the risk of being remapped into a special hazard flood zone. In positive news, the market has come up with some compelling and well-priced private flood insurance options as well as improved diagnostic software and third party websites which more easily allow real estate agents and their clients to determine the impact of the flood plain on a particular property. As always, get out ahead of the question of flood insurance because it takes some time to navigate the process of securing the best priced flood policy available. Also, if you need to have an elevation certificate done, expect delays greater than you have seen in the past. Like so many real estate tied professions, surveyors are busier than ever.

Socrates is credited with saying “the only true wisdom is knowing you know nothing.” In the world of insurance, this is very good advice. So often there are nuances and variables with in insurance coverage. The best advice is to work with an independent agent you trust and never hesitate to pick up the phone or send an email when you have a question about coverage.

Jennifer Coffin Earns CPRM Designation

Jennifer Coffin, ACSR, a member of the personal insurance team at Allen Insurance and Financial, recently earned a Certified Personal Risk Manager (CPRM) designation, issued by the National Alliance for Insurance Education and the Council for Insuring Private Clients.

The CPRM designation focuses on all major fields of personal client risk management, coverage differences, lifestyle analysis and protection, and the practical applications of risk management. This achievement signifies a commitment to continuing education.

Coffin also holds the Accredited Customer Service representative (ACSR) designation. She joined Allen Insurance and Financial in 2004.

Benefits and Me Newsletter – May 2021

This month’s Benefits and Me newsletter, shared to our clients by the Allen Insurance benefits division discusses reimbursable PPE expenses, tips for finding medical information and common health insurance terms.

The Internal Revenue Service (IRS) recently announced that amounts paid for personal protective equipment (PPE)—such as masks, hand sanitizer and sanitizing wipes—used for the primary purpose of preventing the spread of COVID-19 are deductible expenses for medical care. Because these amounts are expenses for medical care, the amounts paid for PPE are also eligible to be paid or reimbursed under any of the following:

- Health flexible spending arrangements (FSAs)

- Archer medical savings accounts (Archer MSAs)

- Health reimbursement arrangements (HRAs)

- Health savings accounts (HSAs)

However, if an amount is paid or reimbursed under a Health FSA, Archer MSA, HRA, HSA or any other health plan, it will not be considered a deductible medical expense.

Health Care Reform: Pay or Play Penalty – Special Rules for Educational Organizations

On Feb. 12, 2014, the IRS published regulations on ACA’s employer penalty provisions, including methods for identifying full-time employees for penalty purposes. This ACA Overview summarizes the final regulations’ special rules for identifying full-time employees of educational organizations. Read more on this PDF.

Properly Insuring Your Employees in Case of Injury

Chris Richmond

By Chris Richmond

Originally Submitted to WorkBoat Magazine

Shipyards and marine related business are comprised of a wide variety of jobs and with this variety comes different types of injury coverage for the people who work there. Just because you believe your employees are properly covered does not mean they are. Take a moment to review these three areas of injury coverage.

Jones Act

Officially called “The Merchant Marine Act of 1920,” this covers employees who are considered crew members on your vessels. Seamen employed on vessels traveling from U.S. port to U.S. port are entitled to coverage under the Jones Act, with the coverage provided under a vessel’s Protection and Indemnity policy. Crew are covered for injury and illness while ‘in service to the ship’ through the Maintenance and Cure portion of the coverage. Crew are also entitled to sue the ship or ship owner for unseaworthy or negligent conditions which they believe caused their injury. To be considered a crew member, the employee must spend roughly a third of their time at work in service to the ship.

USL&H

Employees who are working around docks, wharves or servicing a vessel will fall under the U.S. Longshore and Harbor Workers Act. These are your stevedores, repair crew, crane operators or similar employee who service, load or go on and off vessels but are not considered crew members. The two determining factors for USL&H are Situs and Status, both of which need to be met in order to be eligible for this coverage. To meet the Situs test, an injury must have occurred while working on or near navigable waters. The Status test is met by the work being done. Exclusions include office workers, aquaculture and boat builders who build recreational vessels less than 65 feet in length. Even if you have a boat yard where you feel you would never have a USL&H risk, it is very inexpensive to have this added to your state workers compensation policy on an ‘if any’ basis. This way you have at least some defense covered should a USL&H claim be filed against you.

State workers compensation

Your office staff and other employees are covered under your state workers compensation act. Keep in mind that if you have employees who work in other states besides the one where your business is located then you need to list these as well. State workers compensation acts are no-fault laws which means they cover a claim as long as the employee’s accident happened within the scope of their employment.

This is a very quick explanation of a very important insurance coverage. Take the time to review your operation and exposure with your agent to help you get the coverage you need.

Patrick Chamberlin Earns CIC Designation

Patrick Chamberlin, a member of the business insurance team at Allen Insurance and Financial, has earned the designation of Certified Insurance Counselor, one of the insurance industry’s most highly respected designations.

“CICs are recognized for expertise and commitment to the industry and it is no surprise this is a designation Patrick has chosen to pursue,” said Michael Pierce, president of Allen Insurance and Financial. Earning the designation is just a first step on a path of rigorous, annual continuing education, Pierce noted.

Based at Allen’s office in Camden, Chamberlin works with business insurance clients across a wide spectrum of industries. He also holds the Management Liability Insurance Specialist and Commercial Lines Coverage Specialist designations.

The Certified Insurance Counselor program is maintained by the National Alliance for Insurance Education & Research.

To Keep or Not to Keep: A Guide to Common Records-Retention Questions

Living in an increasingly paperless world has its benefits, but when it comes to records retention, does it make a difference? Sure, digital recordkeeping on the cloud means more storage space, easy access, and less vulnerability to inadvertent destruction. But the questions of what to keep and for how long feel just as confusing as ever.

Keep or Toss

Whether your files are physical or electronic, the same principles and time frames for record retention apply. Below, we review some rules of thumb to consider for a few common financial documents. Keep in mind, though, this list is not exhaustive, and professional responsibilities and potential liability risks may vary.

ATM receipts, deposit slips, and credit card receipts.

In general, you don’t need to hold onto monthly financial statements after you verified your transactions—that is, unless statements include tax-related information. Also keep in mind that if you dispute a transaction included in a statement, in most cases, you have 60 days from the statement date. Beyond 60 days, the bank may be alleviated of liability associated with the charge—so you may be on your own to try to get your money back.

Paycheck stubs.

Once you receive your annual W-2, it’s usually not necessary to retain your paystubs for the prior year. You may want to keep your year-end stub if it includes any tax-related information not reported on your W-2, however. Additionally, if you anticipate a life event in the near future that will require proof of recent income—applying for a home loan, for example—then plan to hang onto pay stubs from at least the past two months.

Tax returns.

Determining when to purge tax returns usually depends on how long the IRS has to contest a given year’s return. In most cases, it’s a period of three years—assuming tax returns are filed properly and do not contain any knowingly fraudulent information. The time frame can extend up to six years for severely underreported income, and there’s no time limit for the IRS to contest fraudulent returns. The same timing applies to the supporting documentation used in preparing a tax return, so you should also retain the financial and tax documentation—investment statements showing gains or losses and evidence of charitable contributions, for example—pertinent to the corresponding year’s return. If you’re unsure how long you should keep a specific tax return and accompanying paperwork, be sure to check with your accountant. Additionally, the IRS offers some useful information on time limitations that apply to retaining tax returns.

Old 401(k) statements.

Once you’ve confirmed your contributions are recorded accurately, there’s little need to keep each quarterly or monthly statement. It may be a good idea to keep each annual summary until the account is no longer active, however.

Estate planning documents. Although there’s usually no distinction about whether records need to be retained in paper or digital form, there are certain instances where it’s essential to have original legal documentation with the “wet” signature. This requirement holds true for estate planning documents. In most circumstances, a court will only accept a decedent’s original last will and testament—a copy will not suffice. If you’re unable to produce the original, the court may presume it doesn’t exist, deeming the copy invalid. It’s possible there are legal avenues you can pursue to get the court to accept a photocopy of a will, but this could prove to be a costly and stressful process.

Get Organized and Be Sure to Shred

A good records-filing system is key to helping you maintain and easily access important documents. If you’re storing things digitally, you can retain much more than any filing cabinet could hold, making it easy to take a more liberal approach to what you save. Keep in mind, the retention guidelines for many documents aren’t clear-cut. When you’re unsure, start by assessing what purpose the document may serve in the future. And it’s always important to consult the appropriate financial, tax, or legal professional for advice on specific records. Finally, remember when it comes to materials that include personal information, if you’re not keeping it, then you should be shredding it.

This material has been provided for general informational purposes only and does not constitute either tax or legal advice. Although we go to great lengths to make sure our information is accurate and useful, we recommend you consult a tax preparer, professional tax advisor, or lawyer.

Construction Bonds 101

A construction bond, also known as a surety bond, protects a project owner if a contractor fails to complete a job, doesn’t pay for permits or fails to meet other financial obligations such as paying for supplies or subcontractors.

Surety bonds are important, and quite common, in the construction industry. They typically come in three types:

- A Bid Bond is issued to the project owner to provide a guarantee that the winning bidder will honor the contract under the terms at which they bid.

- A Performance Bond guarantees that the contractor will perform the services as described in the contract. A bid bond is replaced by a performance bond when a bid is accepted and the contractor proceeds to work on the project.

- A Payment Bond guarantees that a construction company will pay its laborers (employees and subcontractors) and suppliers throughout the construction project.

A surety bond is a contract between three parties:

- The Principal is the party purchasing the bond and undertaking an obligation to perform the job as promised.

- The Obligee is the party requiring and receiving the protection of the bond.

- The Surety is the insurance company or surety company that guarantees the obligation will be performed.

How do you know if you need a construction bond? The project owner will decide.

Kristina Campbell has been working with contractors across Maine for their insurance and bonding needs for more than 15 years.

Allen Insurance and Financial Earns Diamond Achiever Award in Maine

Allen Insurance and Financial has been named Maine’s 2020 Diamond Achiever by Patriot Insurance Company. The annual award is presented to the highest performing agency based on set criteria including length of appointment, profitability, growth, and policy retention. Each year, the top Patriot Insurance Company agencies receive the “Diamond Achiever” award in recognition of their outstanding accomplishment.

Patriot Insurance Company President and CEO, Lincoln Merrill Jr. explains, “We are proud to present Allen Insurance and Financial with our Diamond Achiever award. Through their hard work and commitment to providing superior services, support and products, it is well deserved.”

This recognition exemplifies their commitment to providing quality, professional insurance products and services to our mutual clients.

The results achieved by the team at Allen Insurance and Financial helped the agency become one of the most successful among Patriot Insurance Company’s more than 115 independent agencies.

“The team at Allen Insurance and Financial is dedicated to providing the protection our clients need accompanied by the highest level of service. We are all very proud to be recognized by our colleagues at Patriot Insurance. Strong partnerships like ours benefit everyone in the industry − carriers, agents and clients, ” said Michael Dufour, executive vice president of Allen Insurance and Financial.

Allen Insurance and Financial has been licensed with Patriot Insurance Company since 1993 is recognized as one of the carrier’s Preferred independent insurance agency partners.

About Patriot Insurance

Patriot Insurance has been providing peace of mind for families and businesses in New England for over 50 years. Headquartered in Yarmouth, Maine, we are a regional carrier offering business, home, auto, life, and surety products backed by local, autonomous claims, loss control, and underwriting teams.

We work exclusively with independent agents who can give our customers the personal guidance and service they deserve. Since 2007, we have partnered with Frankenmuth Insurance, a longstanding company founded in Michigan in 1868. Patriot Insurance is financially sound, with an A.M. Best rating of “A” (Excellent).

- « Previous Page

- 1

- …

- 22

- 23

- 24

- 25

- 26

- …

- 89

- Next Page »