Be smart and stay safe.

Be smart and stay safe.

We urge you to use and maintain your stove, fireplace and chimney properly.

Be smart and stay safe.

Be smart and stay safe.

We urge you to use and maintain your stove, fireplace and chimney properly.

For detailed information and questions, please don’t hesitate to reach out to your Allen Insurance and Financial benefits team. 2020 Checklist (PDF)

Amy Bowen

Amy Bowen, a business insurance account manager at Allen Insurance and Financial recently achieved the designation of Accredited Customer Service Representative in Commercial Lines from the Independent Insurance Agents & Brokers of America.

Based in the company’s office at 94 High St. in Belfast, Bowen has been with Allen Insurance and Financial since 2013.

The ACSR designation program was developed to recognize the contribution made to each customer by the service they are provided through independent insurance agencies such as Allen Insurance and Financial.

Independent Insurance Agents & Brokers of America is the nation’s oldest and largest national association of independent insurance agents & brokers with more than 300,000 members. Find them online at independentagent.com.

Maine’s three providers of individual health insurance on the Affordable Care Act marketplace have revised their rate requests for 2020, significantly lowering their projected rates.

This is good news for anyone who plans to enroll or to renew their coverage in health insurance via the Affordable Care Act for 2020.

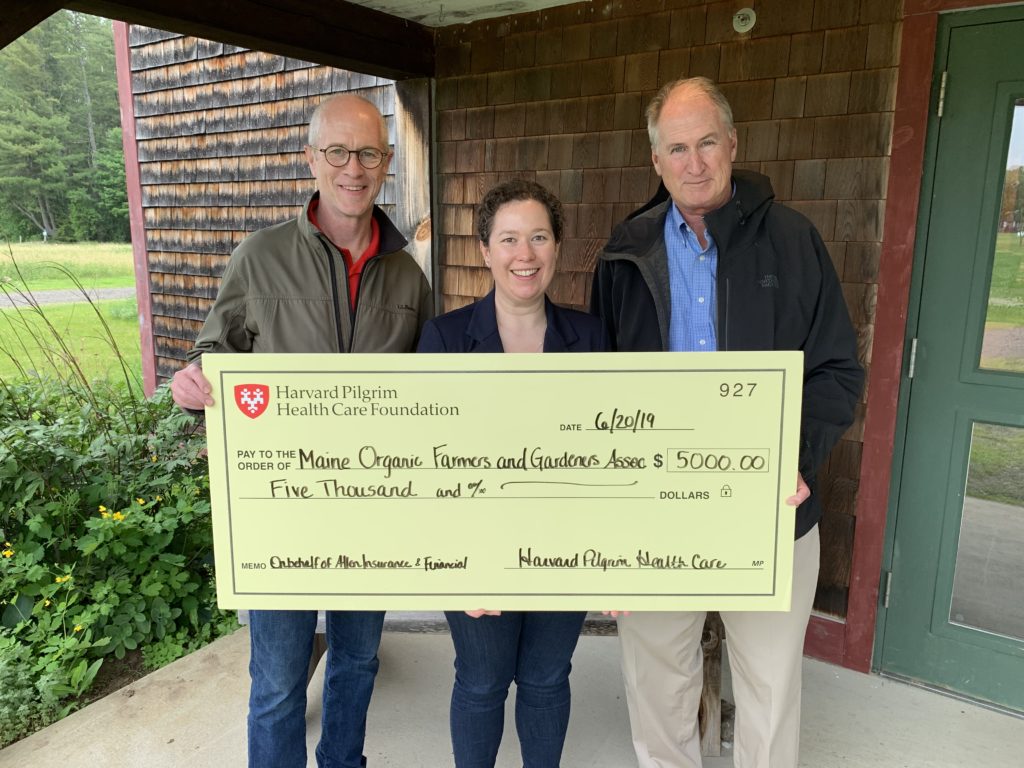

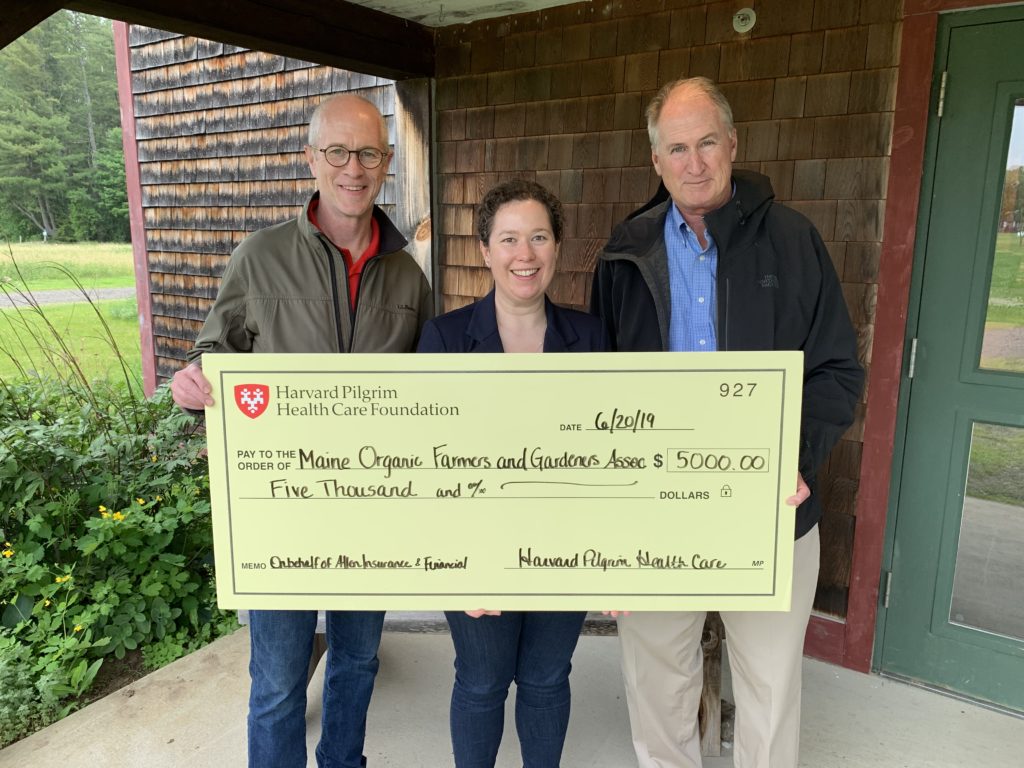

The Maine Organic Farmers and Gardeners Association (MOFGA) recently received a $5,000 grant from Harvard Pilgrim Health Care Foundation and Allen Insurance and Financial to increase access to and affordability of healthy, nutritious food for low income families. MOGFA has a longstanding commitment to help all Maine people acquire local, organic foods regardless of geography or income. Pictured in the photo, left to right, are: Bill Whitmore, Maine Market Vice President, Harvard Pilgrim Health Care; Sarah Alexander, Executive Director, Maine Organic Farmers and Gardeners Association; and Dan Wyman, JD, Insured Benefits Manager, Allen Insurance and Financial.

There are some new rules in Maine around Workers Compensation Insurance and Independent Contractors. The Maine Workers Compensation Board has issued a newsletter with some important information.

Independent contractors are workers who perform services for remuneration under a verbal or written contract, but who are not under the essential control or superintendence of another person, both under the person’s contract of service and in fact. The worker must also meet specific criteria.

In order for a person to be an independent contractor they must meet the test in §102(13-A) of the Workers’ Compensation Act. An independent contractor is not required to have workers’ compensation insurance; however an independent contractor is required to have workers’ compensation insurance for any employees hired by the independent contractor.

Newsletter from Maine Workers Compensation Board – June 2019

From left: Jack Gallagher and Daulton Wickenden

Allen Insurance and Financial is hosting two summer interns in 2019. Both are graduates of Camden Hills Regional High School and attend colleges in Maine.

Jack Gallagher of Camden is a graduate of Thomas College in Waterville and will be working in both the insurance and financial divisions at Allen Insurance and Financial before returning to Thomas this fall to study for his MBA.

Daulton Wickenden of Rockport, who will be a fall 2019 graduate of Husson University, is focused more exclusively in the company’s personal insurance division.

“These internships will provide a complete immersion into the nature of our work at Allen Insurance and Financial,” said company president Mike Pierce. “Jack and Daulton will have the opportunity to put their academic experience to work to complete a variety of business assignments. We look forward to working with them this summer.”

Abraham Dugal

Allen Financial advisors and wealth managers Abraham Dugal and Sarah Ruef-Lindquist, JD, CTFA, were speakers for a session at the Maine Land Trust Network’s day-long Land Conservation Conference held earlier this spring in Topsham at the Middle School.

Dugal and Ruef-Lindquist spoke about issues surrounding how to grow endowments through planned giving, when donors seek to provide long-term support through gifts that can be more complex than cash or marketable securities.

Land trust staff and board members gather annually for the opportunity to network, share organizational best-practices and learn from experts in fields that include conservation, land preservation, marketing and finance. It is produced by the Maine Coast Heritage Trust.

Sarah Ruef-Lindquist, JD, CTFA

Dugal and Ruef-Lindquist spoke about the policy foundations and recognition practices they view as necessary to have fiscally-sound and successful planned giving programs. Their backgrounds – hers as an attorney, financial and philanthropic advisor, trust officer; his as an investment manager and both as board members – contribute to their unique perspectives as advisors and fiduciaries and how they approach potential gifts through clients’ estate and financial planning.

Given the unprecedented intergenerational transfer of wealth taking place in the United States, and the projections for gifts to non-profit organizations during the next 30 to 40 years in the trillions of dollars, organizations are well-served to pay greater attention to this area of resource development to build their long-term financial sustainability.

Sarah Ruef-Lindquist, JD, CTFA

Allen Financial advisor and wealth manager Sarah Ruef-Lindquist, JD, CTFA, was the featured speaker at the June monthly meeting of the Mount Desert Island Nonprofit Alliance at the Garland Farm. MDINA members work collaboratively to address operational issues and coordinate event schedules for the many Mount Desert Island non-profit organizations.

Participant groups who were represented at the meeting included the Schoodic Institute, Friends of Acadia, Seal Cove Auto Museum, MDI Hospital, Abbe Museum and Jessup Memorial Library.

After a brief tour and background presentation from Garland Farm personnel, Ruef-Lindquist spoke about the policy foundations, recognition practices and outreach necessary to have fiscally-sound and successful planned giving programs and endowment funds. Members submitted questions in advance of the meeting ranging from how to begin a planned giving program to how to begin a conversation with a donor about planned giving.

Given the unprecedented intergenerational transfer of wealth taking place in the United States, and the projections for gifts to non-profit organizations during the next 30 to 40 years in the trillions of dollars, organizations would be well-served to pay greater attention to this area of resource development to build their long-term financial sustainability, Ruef-Lindquist said. It is an area in which she has worked as a consultant, philanthropic advisor or trust officer for more than 20 years.