One bad day doesn’t make a bear market. Two bad days, however, and the prospect of more to come, may well signal one.

Bear market is a scary term, and the past several days have certainly given investors cause for concern. Rather than spend time worrying, though, let’s try to understand what has happened and what it means for our long-term financial goals.

Markets decline worldwide, but U.S. fundamentals remain strong

At times like this, it’s worth reviewing where stock prices come from. The two components are earnings (how much companies are making per share) and valuations (how much investors are willing to pay for those earnings). Earnings evolve with the economy as a whole, whereas valuations are much more variable.

Asian markets, particularly China’s, are suffering from a double hit. Earnings growth has slowed substantially for many companies, making them worth less even if valuations remain constant. Valuations, however, have been dropping sharply as investors lose confidence in the economy and in future growth. This double whammy has slammed markets in China and around the world, and it may well continue.

In Europe, the turbulence in China has sapped confidence, but the damage has been mitigated by relatively strong fundamental economic and corporate performance. This shows that investors are still making rational distinctions between markets—a positive sign—and also allows for confidence to recover as fundamentals continue to improve.

Right now, with the exception of energy, the U.S. economy continues to grow at a reasonably healthy rate—better than European economies. Corporate earnings, which are based on the economy as a whole, are relatively strong outside of the energy sector. Even there, lackluster earnings are due to low oil prices, which actually help the rest of the economy. In any event, earnings are expected to increase over the next year.

Just as in Europe, any declines in U.S. markets will be based on what investors are willing to pay for a given stream of earnings, and valuations may well recover as confidence improves again.

A closer look at U.S. market valuations

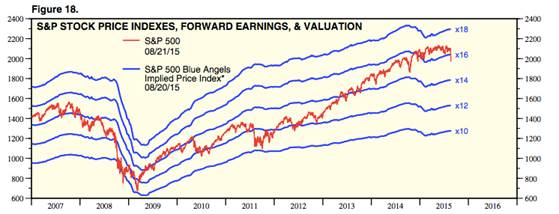

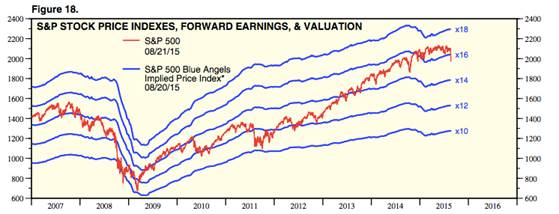

The following chart from Yardeni Research shows how U.S. stocks have been valued with respect to expected earnings over the next 12 months, from before the financial crisis to now.

We can see that stocks were priced at around 15x earnings before the financial crisis, dropped to about 10x at the bottom of the crisis, subsequently recovered to around 12x–14x, and then moved to a higher range, over 14x, in 2014.

With forward earnings now at $127.72, the close on Friday, August 21, left us at a valuation of 15.4x earnings, in line with where stocks were in 2007, suggesting the market may have further to go on the downside. In the short term, this is upsetting, but we need to remember that, while valuations cycle between good and bad, earnings continue to grow. Note that valuations have cycled between 10x and almost 18x, and that they have recovered from extremely low levels.

Putting it all in perspective

When we consider where we are now, compared with where we have been, it’s important to make the following distinctions:

- In the financial crisis, the banking system was in jeopardy. Now it is far more solid, with much higher levels of capital and much lower exposure to risky areas.

- In the financial crisis, U.S. consumers and businesses had large stocks of debt and the housing sector was collapsing. Now, the housing market has normalized and household debt has come down substantially to a healthy level.

- Supportive economic factors are in place—namely, Federal Reserve policy and low oil prices, both of which continue to stimulate the economy.

- Combined, these facts suggest we’re unlikely to see the low market valuations that we saw in the financial crisis of 2008. Although we may experience further declines, they will be constrained by the much healthier economic and financial position the U.S. now finds itself in.A better comparison is probably to the Asian financial crisis. As that situation deepened in 1998, U.S. markets dropped substantially, only to recover shortly thereafter. The damage was real but short lived, as strong U.S. economic fundamentals supported markets and investors from other parts of the world moved capital into what they perceived as a safe haven.Given that the problem here in the U.S. is largely related to confidence, it’s logical to think that the market will recover as fundamentals continue to improve. We’ve gone several years without a significant decline, and the first was bound to be unsettling. In reality, though, the market’s foundations remain solid.

Taking the long-range view

Over the longer term, this type of adjustment is normal and healthy. Periodic downturns clear out market excesses and set the stage for further advances. To put the recent decline in context, the market is still up substantially over the past five years. And, although down over the past 12 months, it remains above the levels of October 2014, when it dropped and then fairly quickly recovered.

As always, the key is to remain focused on your long-term objectives rather than short-term fluctuations. As unsettling as recent market movements have been, the real economy continues to improve. That, not short-term price fluctuations, is what will determine the ultimate success of your investment process.

Forward-looking statements are not guarantees of future performance and involve certain risks and uncertainties, which are difficult to predict. All indices are unmanaged, and investors cannot invest directly in an index. Unlike investments, indices do not incur management fees, charges, or expenses. Past performance is no guarantee of future results.

###

Authored by Brad McMillan, CFA®, CAIA, MAI, chief investment officer at Commonwealth Financial Network.

© 2015 Commonwealth Financial Network®