Over the past year, we’ve all felt the effects of the coronavirus pandemic in one way or another. But, as the job losses and unemployment numbers tell us, it’s staggeringly clear that women—particularly women of color—have been disproportionately affected. Women have lost or scaled back their careers, with their labor force participation now at a 30-year low. At the same time, their responsibilities in terms of child care and home schooling have risen by more than six hours per day. For many, it’s reached a crisis point.

If you’re one of the many women whose lives and finances have been turned upside down by the pandemic, you might be struggling with what to do next. Fortunately, there are strategies to address your immediate concerns and help you plan for a healthy financial future.

A Taxing Time

Unemployment compensation. Did you know unemployment compensation is taxable, including the additional weekly $600 authorized by the CARES Act? (To learn more, see Form 1099-G, Certain Government Payments.) At the state level, only five states that tax income—California, Montana, New Jersey, Pennsylvania, and Virginia—do not tax unemployment benefits.

In recent news, the American Rescue Plan Act (ARPA) signed by President Biden on March 11, 2021, includes some tax relief. Under ARPA, the first $10,200 of unemployment benefits received in 2020 will be tax-free for individuals whose modified adjusted gross income (MAGI) is less than $150,000.

If you are unemployed and will continue to receive unemployment payments in 2021, there’s a simple solution to minimize any future tax surprises: complete Form W-4V to voluntarily withhold taxes from your unemployment benefits. The withholding rate is a flat 10 percent.

Coronavirus-related distributions (CRDs).

If you supplemented your cash flow with CRDs from an IRA or other retirement plan (e.g., 401(k)), you will have more complex choices to consider. To help make the decision that’s right for you, it’s important to know all of the options:

- The full amount of the distribution may be reported as income in the year it’s distributed.

- The full amount of the distribution may be reported ratably in one-third increments spread over three years. For example, an individual who received a $9,000 CRD in 2020 would report $3,000 in income in 2020, 2021, and 2022.

- Individuals have a three-year window that begins the day after they receive a distribution to recontribute all or a portion of it to a retirement plan or IRA.

- Individuals who reported a CRD and then rolled it back into an IRA or retirement plan can claim a refund for the income tax paid in a prior year.

Please note: The choice to report a distribution in one year or to spread it out ratably over three years is irrevocable, so it requires careful consideration.

Health Care Coverage

Health insurance can be the biggest immediate worry after losing a job, especially for single mothers who can’t rely on a spouse’s coverage. Fortunately, there are several options at your disposal. For example, you may be eligible for Medicaid coverage, especially if you live in one of the 39 states that recently expanded the Medicaid program. Alternatively, the Affordable Care Act’s (ACA’s) Health Insurance Marketplace provides all Americans with nationwide access to health insurance.

Extended open enrollment. For those who missed the fall open enrollment period for ACA insurance or who want to make changes to their plan, the federal government is holding an extra open enrollment period through May 15, 2021. State-based marketplaces are another option in California, Colorado, Connecticut, Idaho, Maryland, Massachusetts, Minnesota, Nevada, New Jersey, New York, Pennsylvania, Rhode Island, Vermont, Washington, and the District of Columbia.

You’ll need to check each state’s enrollment timeline. If you lose your job after May 15, you will still have a 60-day special enrollment period to find health insurance in either the federal or state marketplace. Marketplaces have links to information about eligibility for premium subsidies and assistance for selecting the right plan.

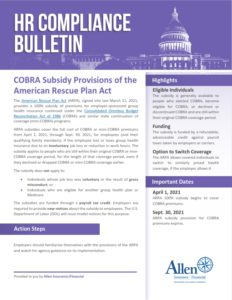

COBRA. Another option is COBRA, though it’s more expensive. You could be covered by this plan—and keep the health insurance policy you had while employed—for 18 months after a layoff or reduction in work hours. Unfortunately, COBRA coverage may cost up to 102 percent of the health plan’s full premium.

Short-term plans. Other options, such as short-term health plans, which can be used for up to 36 months, may offer only limited benefits. Unlike ACA plans, short-terms plans aren’t required to provide the following 10 essential health benefits:

- Laboratory services

- Emergency services

- Prescription drugs

- Mental health and substance use disorder services

- Maternity and newborn care

- Rehabilitative services

- Ambulatory patient services

- Preventive and wellness services and chronic disease management

- Hospitalization

- Pediatric services, including vision and dental care

Keep in mind that insufficient coverage for any of these health care needs could expose you to bills that will affect your family’s financial security for years. As such, addressing this issue now is vital in coping with the pandemic’s long-term effect on your finances.

Careers in Transition

The Women in the Workplace 2020 report from McKinsey and Lean In highlighted several structural factors causing one in four women to downshift their career or stop working altogether. Among the primary culprits, according to the McKinsey report, are concerns that employers view caregivers of children and adult parents as not fully committed to their jobs. But shifting priorities and changing a career path to meet a present problem will affect your future social security benefits, retirement security, and household net worth.

Social security. Social security retirement benefits are based on an individual’s primary insurance amount (PIA), which is calculated from your average indexed monthly earnings during your 35 highest earning years. Social security records a zero for each year that you do not earn income. More zeros—especially during the primary earning years after age 40—can reduce your PIA and cannot be recouped through later employment. Although you may think your absence from the workforce will be temporary, it may lead to an extended time away from employment.

Retirement savings. Even if your career is in transition, there are still ways to save for retirement. For instance, you can contribute to a spousal traditional or Roth IRA if you are married, file a joint income tax return, and have a modified adjusted gross income (MAGI) below the threshold set for that tax year. If you are older than 50, you can make an extra $1,000 catch-up contribution, as long as your MAGI is below the annual threshold. The amount you can contribute to a spousal IRA will begin to phase out within certain MAGI ranges, and it will end once MAGI exceeds an annual specified limit. Spousal IRAs are available for all married couples, including same-sex unions.

Planning for a Healthy Post-COVID Life

As we settle in to 2021, vaccines bring hope that the medical risks may soon be behind us. Unfortunately, that is unlikely to quickly reverse the damage to women’s earnings. It is a difficult time, but you needn’t navigate it alone. We are here to help you consider all the options when it comes to unemployment compensation, health care, social security, and retirement savings to help stabilize your immediate cash flow and get you back on the road to long-term financial security.

Authored by Anna Hays, JD, LLM, advanced planning consultant, Commonwealth Financial Network®. © 2021 Commonwealth Financial Network