By Sarah Ruef-Lindquist, JD, CTFA

By Sarah Ruef-Lindquist, JD, CTFA

Every client has heard me talk about the keys to managing risk in their portfolios. One of those keys is diversification. This can be hard for people who are convinced they know what industry or sector is going to ‘always’ do well, so they are willing to overconcentrate there, or have stock they’ve held for a long time or received as a gift or inheritance and have grown emotionally attached or sentimental about it.

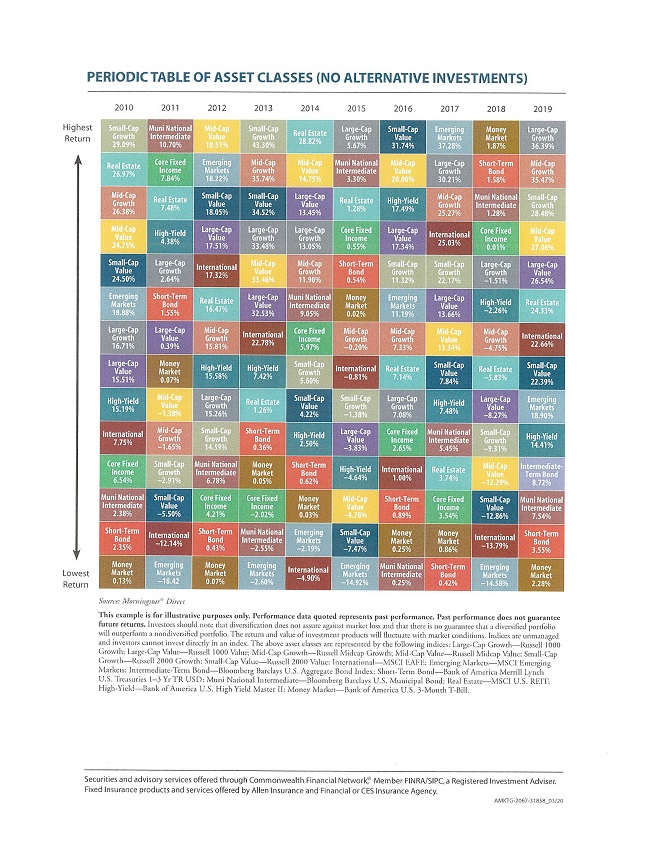

If history is a guide, then diversification is key to managing risk in a portfolio. Looking over the last 10 years, beginning with 2010 and looking at 14 recognized asset classes, like Small-Cap Growth, Real Estate, High-Yield bonds, Large-Cap Value, and their rank each year from highest to lowest return, the numbers tell the story.

For instance, some investors feel that owning large-cap growth stock is the key to their long-term success. It certainly is a strong performer but relative to the 13 other asset classes in this chart, it has been the top performer only 2 out of the past 10 years (2015 @ 5.67% and 2019 36.39%).

Small-Cap Growth has also been the top performer for 2 out of those 10 years with impressive numbers (2010 @ 29.09% and 2013 @43.3%). Ironically, Money Market was the top performer in 2018, in a year when Large-Cap Growth was 5th on the list, and Small Cap Growth was 10th. In 8 of the 10 years studied, Money Market is in the lower 7 classes out of the 14, sometimes with less than 1% performance, but never negative over those 10 years…with at least one sector performing below Money Market 7 out of 10 of those years.

Diversification can allow an investor to have at least a toe hold in as many asset classes as possible to reduce the risk that comes with investing. Some people achieve diversification by buying stocks and bonds in as many classes as feasible, although an even higher level of diversification can be achieved with mutual funds or exchange-traded funds that hold a diversified portfolio either by sector, capitalization or in the case of bonds, length of maturity, government or corporate.

These asset classes for the most part do not take into account another dimension of diversification, which is industry sector, like industrials, energy, consumer staples. Diversifying among sectors within a portfolio is also a layer of this strategy to reduce the likelihood that one sector’s underperformance will disproportionately impact the performance of a portfolio.

In 2020, during the first half of the year, looking at the 11 sectors of the S&P 500, technology stocks outperformed the other sectors at 15%, while energy underperformed the sectors and -35.3% according to Fidelity, https://www.fidelity.com/viewpoints/investing-ideas/quarterly-sector-update. The average performance of all the sectors in the S&P 500 was -3.1%. Contrast 2010, when energy performed at 20.46% and technology at 10.22% according to Invesco, https://www.invesco.com/pdf/U-SPSECTOR-FLY-1.pdf.

In conjunction with your financial advisor, in addition to defining goals and risk tolerance, consider a level of diversification that aligns with both. Having exposure in many asset classes and sectors can help a portfolio weather the volatility that can negatively impact value.