In today’s digital age, artificial intelligence (AI) has transformed how we shop, communicate, and manage our finances. From budgeting apps to automated bill payment systems that track spending patterns, AI tools provide convenient ways to monitor and organize your financial life. They’re available 24/7, typically cost less than human services, and can process vast amounts of data in seconds.

With all these benefits, you might wonder: Do I still need a financial advisor? The answer is a resounding yes. While AI brings impressive capabilities to financial services and can certainly supplement your financial strategy, it falls significantly short of replacing the comprehensive value a human advisor provides. Here’s why the human touch remains essential in financial planning.

Human Understanding and Emotional Insight

AI excels at analyzing numbers and identifying patterns, but financial decisions aren’t just about the math—they’re deeply personal, tied to your life goals and values.

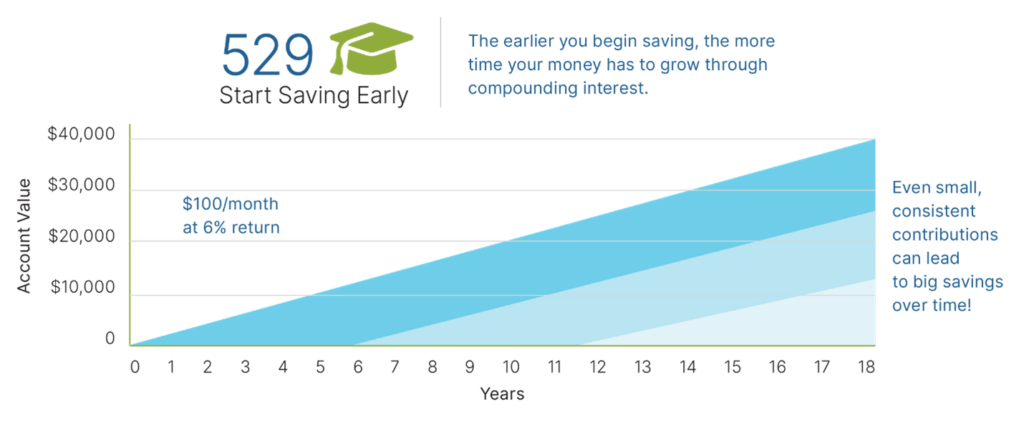

An AI-enhanced tool may calculate the maximum amount to contribute to a retirement plan or education funding, basing the figure purely on numbers. Still, it won’t understand the deeper emotional significance—the pride in helping family, the desire to leave a meaningful legacy, or how their own experiences with financial hardship affect what they consider “enough” for retirement security. These emotional dimensions require the human understanding a financial advisor provides.

Human advisors bring emotional intelligence to the table. They can help you process the complex emotions that often come with money decisions—whether it’s the anxiety of market volatility or the excitement of buying a home. Unlike AI, a human advisor can recognize when the “rational” financial choice isn’t the right one for you emotionally and help you balance both.

Regulatory Knowledge and Technical Expertise

Financial advisors stay current on the ever-changing landscape of tax laws, retirement rules, and financial regulations—areas where AI might lag unless specifically updated.

When tax laws change (as they often do), your advisor will understand how these changes affect your specific situation and can adjust your strategy accordingly. They can tell you when it makes sense to harvest tax losses, which retirement accounts to draw from first, or how new regulations might affect your estate plan.

This specialized knowledge becomes particularly valuable during major life transitions. When you’re navigating a career change, inheritance, or retirement, your advisor can bring technical knowledge and contextual understanding that automated systems simply can’t match.

Complex Family Dynamics

Financial planning often extends beyond individual goals—it could involve navigating complex family relationships and financial legacies.

Issues like inheritance planning, supporting aging parents, or managing family business assets require sensitive conversations and thoughtful solutions. Dividing an estate fairly among siblings or deciding how to support a child with different financial needs involves more than just math—it requires emotional insight and negotiation skills that AI lacks.

An advisor who knows your family history and financial dynamics can offer tailored advice that AI can’t replicate. They can help prevent family conflicts over money and create plans that honor both financial efficiency and family harmony.

Behavioral Coaching and Accountability

Money decisions aren’t just logical—they’re psychological. Fear, greed, and overconfidence can cloud judgment, even when the data points one way.

A good financial advisor acts as a coach, helping you manage emotional reactions and stay focused on long-term goals. AI might send automated “stay-the-course” messages, but it can’t replicate the impact of a trusted advisor reminding you of your objective-driven strategy and reassuring you during uncertain times. Your advisor knows your financial history and can remind you of how you’ve weathered previous market downturns when panic starts to set in.

Data Privacy and Security

AI tools that handle sensitive financial information are potential targets for hacking and data breaches. While human advisors are also vulnerable to cyberthreats, they provide added layers of protection, such as secure communication channels and strict confidentiality protocols.

Additionally, when you work with a human advisor, you know exactly who has access to your financial information. With AI platforms, especially free ones, your data might be shared with third parties or used for purposes beyond your immediate financial needs.

Real-Time Adaptation and Strategic Insight

AI relies on historical data to make decisions, but it can’t fully anticipate unprecedented events or shifting market conditions.

During a market crash, AI might recommend selling assets to minimize short-term losses because that’s what the algorithm suggests. A human advisor, however, can step in, remind you of your long-term goals, and help you stay the course—potentially avoiding costly decisions driven by panic.

Beyond market fluctuations, life itself is unpredictable. Divorce, an unexpected illness, or a sudden career opportunity can change your financial picture. An advisor who knows you and your goals can adjust your plan thoughtfully, considering both financial and personal factors. AI can’t replicate that kind of nuanced, real-time guidance.

The Value of Human Advice

Perhaps the most compelling reason human advisors remain essential is their ability to serve as true thinking partners. They bring perspective gained from working with hundreds of clients through different life stages and market cycles. They understand not just how markets work—but how people work with money.

Human financial advisors are legally required to act in your best interest. AI tools, on the other hand, are not held to the same ethical standards. In some cases, algorithms may be designed to prioritize the platform’s profitability over your financial well-being. Having a human advisor helps ensure that your interests remain the priority.

AI will continue to evolve and enhance financial services, but the human connection, contextual understanding, and strategic guidance that advisors provide are irreplaceable. The future of financial advice isn’t about choosing between human and artificial intelligence—it’s about combining the strengths of both to create better financial outcomes for you and your family.

© 2025 Commonwealth Financial Network®