Every parent wants to give their child the best possible future, and for many families, that includes higher education. But with tuition costs continuing to rise, figuring out how to pay for college can feel overwhelming. The good news? Starting a college fund early gives your savings more time to grow, making it easier to manage those future expenses.

529 Plans: A Popular Tool for College Savings

When it comes to saving for a child’s education, 529 college savings plans are one of the most widely used and versatile options. These state-sponsored accounts are specifically designed to help families save for qualified education expenses, and contributions grow tax free as long as they’re used for qualified expenses. Because of their flexibility and tax advantages, they’re one of the most popular ways to save for college. Begin by evaluating your state’s 529 plan, as that’s often the best place to start for state tax benefits. However, you’re not limited to your own state’s plan—you can choose almost any state’s 529 program that fits your needs.

Here’s how they work:

- Contributions: Money added to a 529 plan is invested in a selection of funds or portfolios chosen by the account owner.

- Growth: Earnings grow tax free, meaning you won’t owe federal taxes on the investment gains as long as the money is used for qualified education expenses.

- Withdrawals: Funds can be used for tuition, fees, room and board, books, and even some K–12 tuition (in certain states) or trade schools.

Let’s say you start contributing $200 monthly when your child is born. By the time they’re 18, assuming a 6 percent annual return, you could have about $75,000 saved—and all the earnings would be tax free when used for education.

Tax Benefits

One of the biggest advantages of a 529 plan is its tax efficiency. Contributions are made with after-tax dollars, but the account’s growth and qualified withdrawals are tax free. Some states even offer tax deductions or credits for contributions, adding another layer of savings.

For example:

- If you contribute $5,000 to a 529 plan in a state offering a 5% tax credit, you could save $250 on your state taxes that year.

While $250 may not seem like much, over time, these tax savings can make a meaningful difference—reducing your overall education costs just by choosing the right savings plan.

Investment Options, Age by Age

529 plans typically offer a range of investment portfolios, from aggressive growth funds to conservative options. Your child’s age and your comfort with risk will help guide your investment choices.

In the early years (ages 0–10), it often makes sense to invest more aggressively, with a higher allocation to stocks that have the potential for long-term growth. By the time your child reaches middle school (ages 11–15), gradually shifting to a more balanced approach can help manage risk. As college approaches (ages 16+), many families move to more conservative investments, such as bonds or money market funds, to help protect savings from market downturns.

Keep in mind, many plans also offer “age-based” portfolios that automatically adjust the investment mix as your child gets closer to college age.

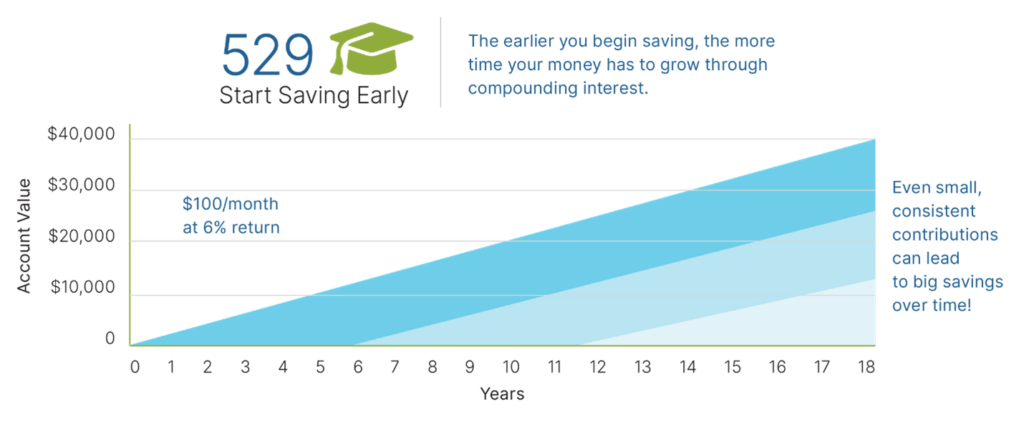

Starting Early

Time is your greatest ally when it comes to compounding growth, so it’s ideal to start as soon as possible. Setting up automatic monthly transfers often works better than trying to make larger annual contributions. For example, contributing $100 monthly feels more manageable than coming up with $1,200 at year-end. If you start contributing that $100 monthly at your child’s birth, earning an average annual return of 6 percent, you could have nearly $40,000 saved by the time they turn 18. Plus, regular contributions help you take advantage of market ups and downs through dollar-cost averaging.

Here are a few tips to get started:

- Set up automatic contributions: Most 529 plans allow you to schedule recurring deposits, making it easier to stay consistent.

- Start small: Even $25 a month can grow substantially over 18 years. Note that some plans do implement minimum contribution thresholds, though these are generally very low.

- Gift contributions: Encourage family members, such as grandparents, to contribute to the 529 plan as part of holiday or birthday gifts. College savings works best as a family effort, with everyone pulling together toward the shared goal of providing educational opportunities for the next generation.

What If Your Child Doesn’t Pursue College?

Worried about what happens if your child doesn’t go to college? 529 plans offer plenty of flexibility:

Change the beneficiary: The account can be transferred to another family member of the beneficiary, such as a sibling, cousin, grandchild, or even yourself.

Use it for other education-related expenses: Use the money for trade schools or vocational training or put it toward K–12 tuition (up to $10,000 annually, but only in certain states).

Withdraw funds: If the funds are withdrawn for nonqualified expenses, the earnings portion will be subject to taxes and a 10 percent penalty, but the principal contributions are not penalized.

Repurpose the funds: Recent changes in legislation allow up to $35,000 of unused 529 funds to be rolled into a Roth IRA for the beneficiary (subject to certain conditions).

This flexibility ensures that your savings don’t go to waste, even if plans change.

Exploring Alternatives

While 529 plans are a popular choice, they’re not the only option. Depending on your family’s circumstances, other accounts might be worth exploring:

Coverdell education savings accounts (ESAs): These accounts offer similar tax advantages to 529 plans but with lower contribution limits ($2,000 annually per child, subject to certain limits) and more flexibility in investment options.

Custodial accounts (UTMA/UGMA): These accounts allow you to save money in a child’s name, which they gain control of upon reaching adulthood. However, earnings are subject to taxes, and the funds can be used for any purpose—not just education.

Each option has unique benefits and trade-offs, so it’s helpful to compare them carefully before making a decision.

Building a Brighter Future

Starting a college fund early may seem like a daunting task but breaking it into manageable steps can help you stay on track. Whether you choose a 529 plan, a Coverdell ESA, or another option, the key is to begin as soon as you can and contribute consistently.

Saving for college doesn’t have to be overwhelming. By starting early, taking advantage of tax-advantaged accounts, and making saving a family effort, you can turn today’s small contributions into tomorrow’s opportunities—helping your child chase their dreams with confidence.

The fees, expenses, and features of 529 plans can vary from state to state. 529 plans involve investment risk, including the possible loss of funds. There is no guarantee that an education-funding goal will be met. In order to be federally tax free, earnings must be used to pay for qualified education expenses. The earnings portion of a nonqualified withdrawal will be subject to ordinary income tax at the recipient’s marginal rate and subject to a 10 percent penalty. By investing in a plan outside your state of residence, you may lose any state tax benefits. 529 plans are subject to enrollment, maintenance, and administration/management fees and expenses.

This material is intended for informational/educational purposes only and should not be construed as investment advice, a solicitation, or a recommendation to buy or sell any security or investment product. Please contact your financial professional for more information specific to your situation.

© 2025 Commonwealth Financial Network®