By Sarah Ruef-Lindquist

Originally Submitted to the Pen Bay Pilot Wave

Many investors have a chunk of their portfolio in a fixed income allocation; that could include domestic and international corporate bonds of varying grades of credit quality and domestic municipal or government issued bonds. Very often “balanced” allocation strategy will anticipate a lower level of volatility and a lower growth in value potential through bonds, while anticipating the yield bonds generate providing income to investors that may be higher than many dividend-producing stock.

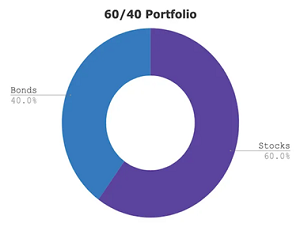

An often-used allocation strategy is 60/40: 60% stock, 40% fixed income. Extolling the virtues of this approach on their website, Vanguard reminds us:

Portfolio outcomes are primarily determined by investors’ strategic asset allocations. And this is good news because, with proper planning, investors with balanced portfolios should be well-positioned to stay on course to meet their goals, instead of swerving to avoid bumps in the road.

Since the Great Recession, in a low interest-rate environment, yields on US bonds have been more modest, reducing the amount of income investors can expect from them. However, they have tended to provide a cushion in overall value dips, because of their lower level of volatility in comparison to the holdings within the stock allocation.

But now rates are rising; the Federal Reserve is working to reduce the growth of inflation by making money more expensive to borrow than it has been in over a decade, curbing borrowing, and that’s pushing rates higher.

Higher rates are great for new bonds and their investors…but it can depress the relative value of existing bonds with lower rates. In the current market downturn in the first quarter of 2022, what investors are seeing is not only a dip in the value of their stock portfolios after reaching historic high values, but a decline in the value of their bond portfolios as well. That’s painful. Many are scratching their heads.

Two things to remember about bonds: their relative value may be lower, but they still have their yield, or income. Secondly, when a bond matures, it almost always pays the investor back the original value of the bond, even though it’s value on paper has reflected a lower “market value” during the period of rising rates. The more patience an investor can exercise over their bond portfolio in these times, the greater the reward.

As you monitor the health of your investment portfolio with your financial and investment advisor, be sure your allocation strategy fits your own unique goals and risk tolerance.