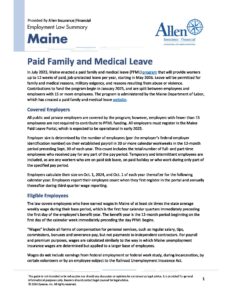

Maine’s Paid Family and Medical Leave Act (MPFML) is designed to provide workers up to 12 weeks of paid, job-protected leave per year, starting in May 2026. Leave will be permitted for family and medical reasons, military exigency and reasons resulting from abuse or violence. While the 1% state premium tax took effect on January 1, 2025, the first paid benefits won’t begin until May 1, 2026. This long lead time allows the state to pre-fund the program, and it gives businesses time to prepare for possible alternatives.

Insurance companies should be ready soon to provide quotes for private replacement plans. If your business has 15 or more employees and you would like us to contact you when quoting is available, please fill out the form below.

The state will begin accepting applications for private insurance plans that can substitute for the state-run program on April 1. If approved, employers would be excused from paying the state’s 1% premium after the first quarter of 2025. With private plans commencing coverage on May 1, 2026, this strategy could create significant cost savings for businesses during the interim, without any loss in benefit coverage.

This PDF has additional information, including a handy chart to help determine whether an employee is eligible for this program.